Introduction to Personal Loans

Financial Potential: Unlocking your financial potential can seem daunting, but with the right tools and guidance, it’s entirely achievable. Personal loans are a versatile option that can help you tackle unexpected expenses, fund major purchases, or consolidate debt. One prominent player in this field is HSBC, known for its competitive rates and flexible offerings. Whether you’re eyeing a dream vacation or looking to renovate your home, understanding how personal loans work—and what HSBC has to offer—can put you on the path to achieving your financial goals. Let’s dive into everything you need to know about personal loans from HSBC and discover how they can empower you financially.

The Benefits of Taking Out a Personal Loan with HSBC

Taking out a personal loan with HSBC offers various advantages that can significantly enhance your financial journey. One of the standout features is competitive interest rates, which can save you money over time compared to other lenders.

HSBC’s flexible repayment terms cater to individual needs. You can choose a plan that fits seamlessly into your budget, reducing financial stress. Their transparent fee structure means there are no hidden costs lurking around the corner, providing peace of mind.

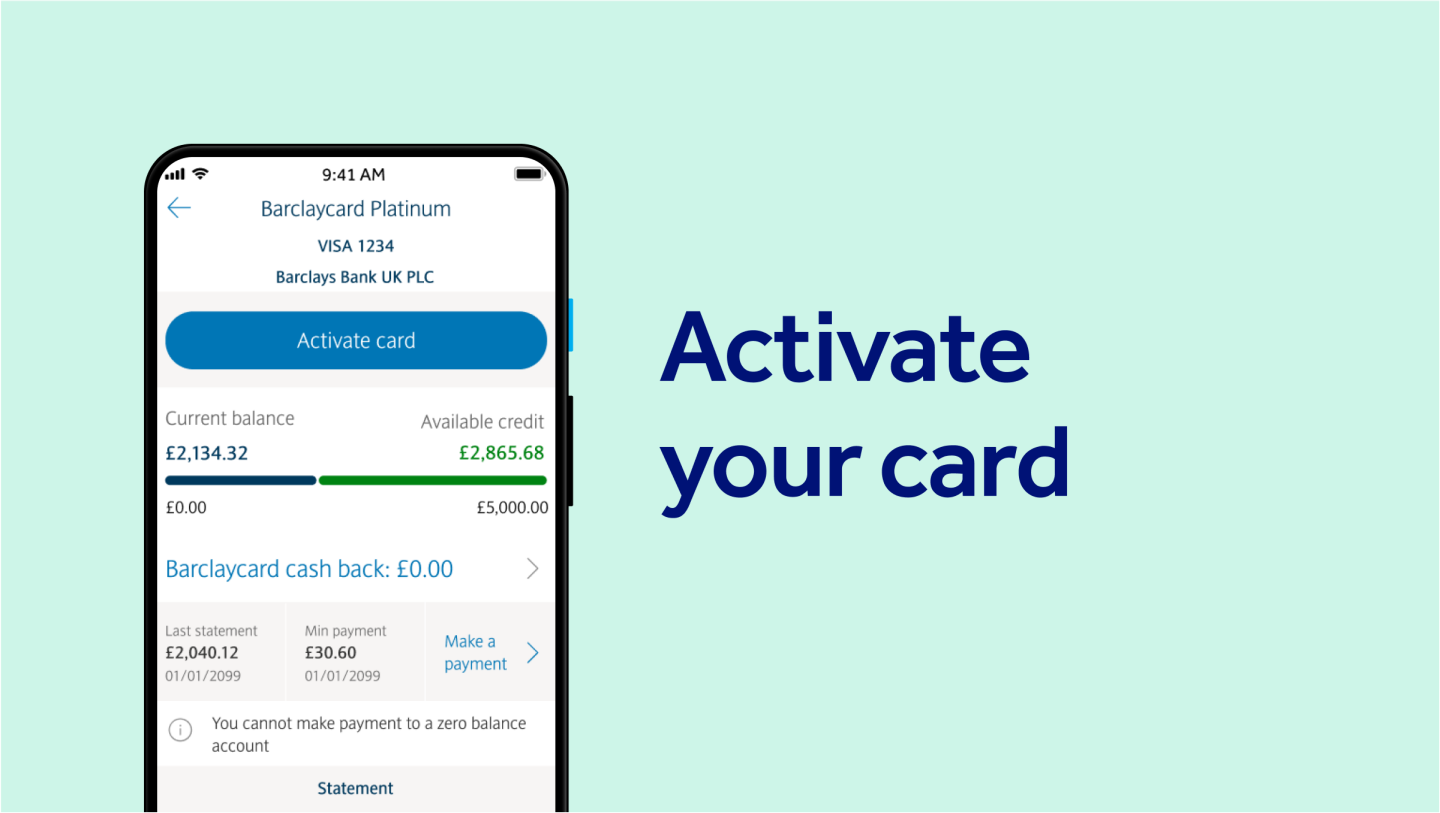

Additionally, applying for a personal loan with HSBC is straightforward and efficient. Their online application process is user-friendly and quick, allowing you to access funds when you need them most.

Moreover, existing customers enjoy personalized service tailored to their circumstances. This level of attention ensures that you’re not just another number in the system but rather valued as an individual with unique needs and goals.

Understanding the Different Types of Personal Loans Offered by HSBC

HSBC offers a variety of personal loans tailored to meet different needs. Whether you’re looking for funding for a big purchase, debt consolidation, or unexpected expenses, they have options available.

One popular choice is the unsecured personal loan. This type doesn’t require collateral and can be used for almost any purpose. It’s ideal if you prefer flexibility without risking your assets.

For those looking to finance education or home improvements, HSBC provides specialized loans with attractive rates and terms. These are designed specifically to help you achieve your goals efficiently.

If you’re considering consolidating existing debts, their debt consolidation loans can simplify payments by combining multiple debts into one manageable monthly payment. This often leads to lower interest rates and fewer financial stresses.

Each loan option comes with unique features that cater to varying financial circumstances and objectives. Understanding these differences can empower borrowers in making informed decisions about their finances.

Financial Potential: How to Qualify for a Personal Loan from HSBC

Qualifying for a personal loan from HSBC involves several key factors. First, your credit score plays a vital role. A higher score typically increases your chances of approval and may lead to better interest rates.

Next, HSBC looks at your income stability. Demonstrating consistent earnings helps assure lenders that you can manage repayments comfortably.

Additionally, the length of your employment is another consideration. Being with the same employer for an extended period can signal reliability.

Debt-to-income ratio also comes into play. This figure compares your monthly debts to your income and should ideally be low to qualify favorably.

Having a good banking relationship with HSBC might give you an edge in the application process, as they value existing customers who demonstrate responsible financial habits.

Financial Potential: Tips for Managing Your Personal Loan and Repayment Plan

Managing a personal loan can feel daunting, but with the right strategies, it becomes manageable. Start by creating a budget that includes your monthly repayment. Knowing where your money goes helps you stay on track.

Set up automatic payments to avoid missing deadlines. This simple action ensures you never incur late fees or damage your credit score.

Consider making extra payments when possible. Even small amounts can reduce the principal faster and lower interest costs over time.

Keep an eye on your financial situation regularly. If unexpected expenses arise, communicate with HSBC about potential adjustments to your repayment plan.

Don’t hesitate to seek advice from financial experts if needed. They can offer tailored tips based on your unique circumstances and help you navigate challenges effectively.

Financial Potential: Comparing HSBC’s Personal Loan Rates with Other Banks

When considering a personal loan, interest rates play a crucial role. HSBC offers competitive rates that can attract borrowers looking for favorable terms.

However, it’s essential to compare their offerings with other banks in your area. Some institutions may provide lower introductory rates or special promotions that could save you money in the long run.

Look closely at additional fees and charges as well. A slightly higher rate might be offset by lower origination or service fees elsewhere.

Don’t forget about customer service and support when comparing lenders. A bank that’s easy to communicate with can make the borrowing process smoother.

Always read the fine print before making your decision. Understanding all aspects of a loan ensures you find the best option tailored to your financial needs.

Frequently Asked Questions about HSBC’s Personal Loans

When considering a personal loan with HSBC, many questions arise. One common inquiry is about the application process. It’s straightforward and can often be initiated online.

Borrowers also frequently ask about eligibility criteria. Generally, you need to meet certain income levels and credit score benchmarks.

Interest rates are another hot topic. HSBC offers competitive rates that vary based on your financial profile and loan type.

People often wonder how long it takes to receive funds after approval. Typically, once approved, you may see funds in your account within days.

Some potential borrowers seek information on repayment flexibility. HSBC provides options that allow for various payment schedules tailored to individual needs.

Other common questions about HSBC’s personal loans include:

– What are the minimum and maximum loan amounts available?

– Are there any fees associated with the loan, such as origination fees or prepayment penalties?

– Can I use a personal loan for any purpose, or are there restrictions on how the funds can be used?

– How long is the repayment term for a personal loan with HSBC?

– What documentation do I need to provide during the application process?

– Is collateral required for a personal loan from HSBC?

– Does HSBC offer any discounts or incentives for existing customers who apply for a personal loan?

– Can I apply for a joint personal loan with another individual?

– How does HSBC determine my interest rate and APR?

– Are there any options for refinancing an existing personal loan through HSBC?

Find out more at: https://www.hsbc.co.uk/loans/products/personal/