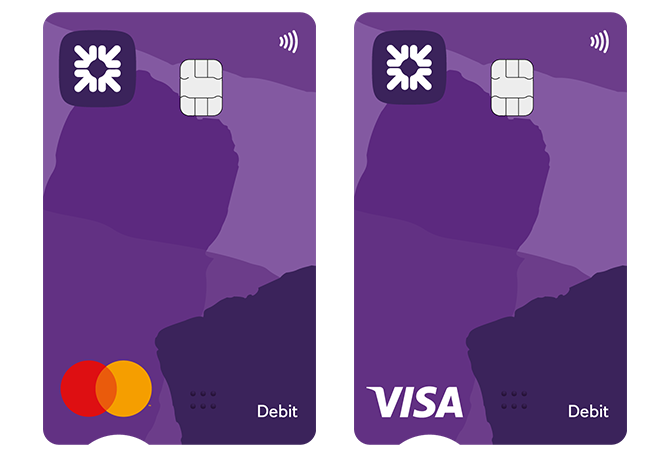

Unlock the power of rewards with the diverse range of credit cards offered by the Royal Bank of Scotland (RBS). Whether you’re seeking opportunities to earn cashback, enjoy balance transfers, or manage your finances more effectively, RBS has a credit card solution tailored to your needs. Explore the features and benefits of RBS’s credit card portfolio and discover how you can maximise your rewards while staying in control of your spending.

RBS, the trusted banking institution, provides customers with a comprehensive selection of credit cards that cater to diverse financial requirements. From low-interest rate options to cards designed for frequent travellers or those seeking generous cashback, the RBS credit card range offers a wealth of choices. Customers can easily check their eligibility and compare the features of different RBS credit cards to find the perfect fit for their lifestyle and spending habits.

With a focus on delivering exceptional customer experiences, RBS empowers its credit card holders to manage their finances with ease. Whether you’re looking to take advantage of balance transfer opportunities, enjoy interest-free credit on purchases, or leverage contactless payment capabilities, RBS has you covered. Explore the latest RBS credit card offers and unlock the full potential of your financial journey.

Explore RBS Credit Cards

Selecting the right credit card can be a daunting task, but RBS makes the process seamless. With a range of credit card options tailored to diverse financial needs and spending habits, customers can find the perfect fit for their lifestyle.

Check Your Eligibility

RBS understands that checking credit card eligibility is a crucial first step. The bank offers a quick and easy eligibility checker that allows customers to explore their options without impacting their credit score. By answering a few simple questions, individuals can determine which RBS credit cards they are eligible for, ensuring a hassle-free application process.

Choose the Right Card for Your Lifestyle

RBS credit cards cater to a wide range of preferences, from those seeking a balance transfer option to those who prioritise rewards and cashback. Customers can explore features such as:

- Purchase rate: 12.9% p.a. (variable)

- Representative APR: 12.9% (variable)

- Annual fee: £0

- Interest-free credit on purchases for up to 56 days if paid in full and on time monthly

- Instalment Plans for existing customers to repay eligible purchases between £100 and £3000 over 3 to 24 months

- Contactless payment with Apple Pay and Google Pay

With detailed information on the benefits and features of each credit card, customers can make an informed decision that aligns with their financial goals and spending habits.

| RBS Credit Card Features | RBS Credit Card Rewards | Credit Card Balance Transfers |

|---|---|---|

|

|

|

Whether you’re looking to earn rewards, transfer balances, or simply manage your everyday expenses, RBS has a credit card solution that can cater to your unique financial needs.

Managing Your RBS Credit Card

Everyday Management: Repayments and Fees

Keeping on top of your RBS credit card repayments and fees is essential for maintaining a healthy credit score and avoiding unnecessary charges. With RBS, you can conveniently set up a Direct Debit to ensure timely repayments each month, whether that’s the minimum amount, a fixed sum, or the full balance. This helps you stay organised and avoid late payment fees.

RBS also provides transparency around their credit card fees, with the annual fee for each product clearly outlined in the terms and conditions. Customers can review these details before selecting the right card for their needs and budget.

Tracking Transactions and Statements

Staying on top of your RBS credit card transactions and statements has never been easier. The bank’s mobile app and online banking platform, ClearSpend, allow you to track every transaction in real-time. You can also set and edit spending limits and categories to better manage your finances.

With ClearSpend, you can access up to 13 months’ worth of credit card statements, which you can download, save, and print as needed. This gives you a comprehensive view of your spending, making it simpler to reconcile your accounts and identify any discrepancies.

| Feature | Benefit |

|---|---|

| Direct Debit for Repayments | Ensures timely payments and avoids late fees |

| Transparent Fees | Detailed in terms and conditions for informed decision-making |

| ClearSpend for Transactions | Real-time tracking, spending limits, and 13 months of statements |

By utilising the tools and features provided by RBS, you can effortlessly manage your credit card, stay on top of your finances, and enjoy a seamless banking experience.

RBS Credit Cards

The Royal Bank of Scotland (RBS) offers a diverse range of credit cards to cater to the varying needs of its customers. From low-interest rate options to cards tailored for travel or everyday spending, RBS provides a comprehensive selection to choose from.

Customers can explore the RBS credit card range, which includes features such as balance transfers, rewards programmes, and additional benefits to enhance their financial experience. The bank’s credit card types cater to different lifestyles and budgets, ensuring customers can find the right fit for their needs.

| Credit Card | Purchase Rate | Representative APR | Credit Limit | Annual Fee |

|---|---|---|---|---|

| The Royal Bank Credit Card | 12.9% p.a. (variable) | 12.9% | £1,200 | N/A |

| credit card | 25.9% p.a. | 31.0% | N/A | £24 or £0 if you have a Reward current account |

| Black credit card | 21.9% p.a. (variable) | 40.7% | £1,200 | £84 or £0 if you have a Reward Black current account |

RBS credit card holders can manage their accounts online, with features such as requesting direct debits, adding additional cardholders, and updating associated email addresses. The bank also provides support on a wide range of topics, from using credit cards abroad to dealing with difficult times, ensuring customers have the resources they need to make the most of their RBS credit cards.

Whether you’re looking for a low-interest option, a rewards-based card, or a premium account with added benefits, the RBS credit card range has something to suit your financial needs. Explore the available options and choose the card that best aligns with your lifestyle and spending habits.

Simplify Your Banking with Digital Tools

At RBS, we understand the importance of providing our customers with seamless and user-friendly digital tools to manage their credit cards. From our intuitive mobile app to our comprehensive digital banking platform, we offer a range of features that empower you to take control of your RBS credit card experience.

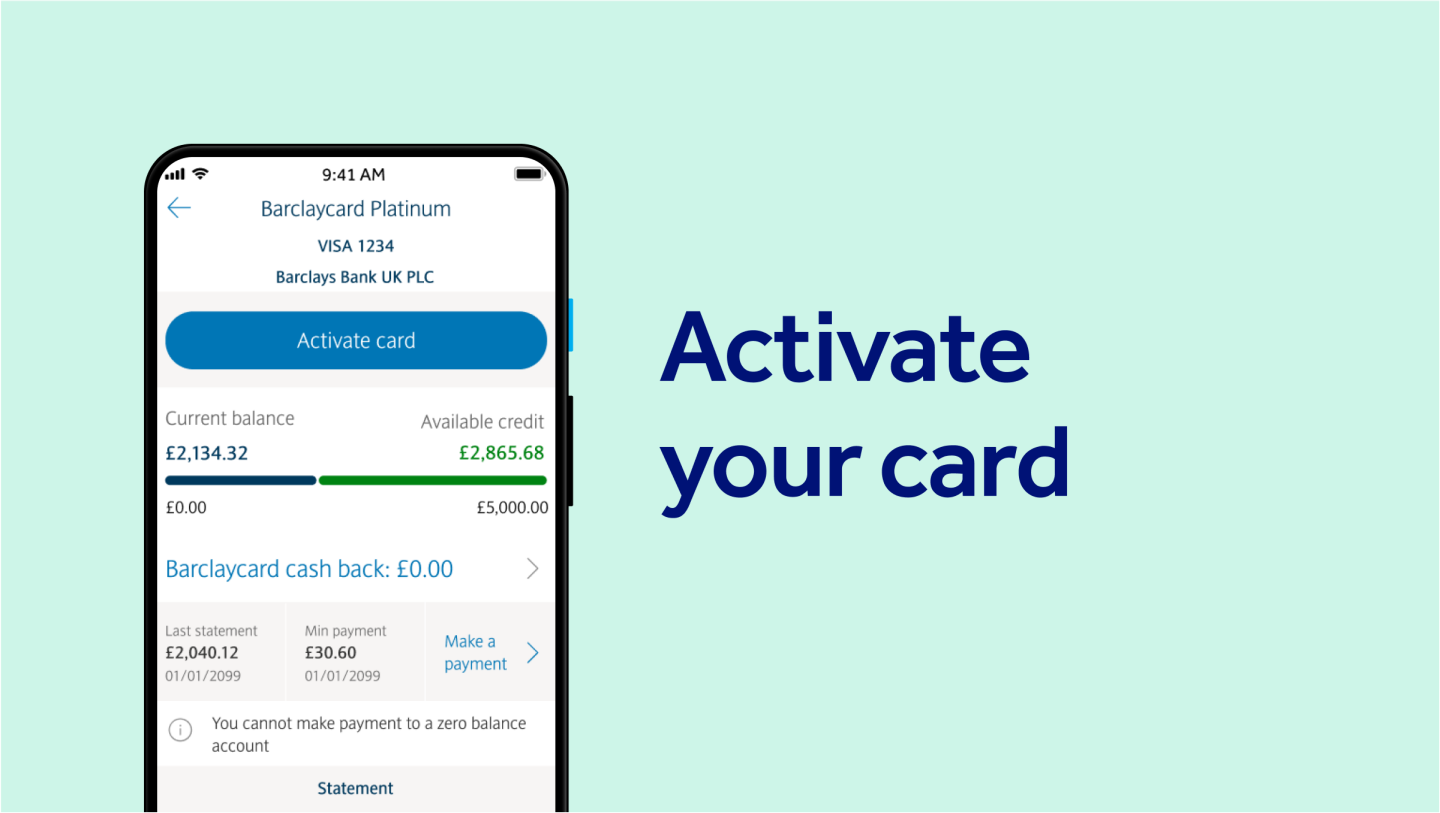

Mobile App Features for Credit Card Management

The RBS credit card mobile app puts the power of credit card management at your fingertips. With just a few taps, you can:

- Lock and unlock your credit card to protect against unauthorised use

- Set personalised spending limits to better manage your finances

- View your transaction history and statements on the go

- Explore your current balance and available credit

Digital Banking for RBS Credit Cards

Our RBS digital banking platform takes your credit card management to the next level. Through our secure online portal, you can:

- Manage your RBS credit card account, including making payments and adjusting credit limits

- Set up convenient Direct Debits to ensure timely repayments

- Request balance transfers and explore other credit card features

- Access detailed transaction records and statements

With these powerful digital tools, you can simplify your banking experience and take control of your RBS credit card like never before. Enjoy the convenience of managing your finances from the comfort of your device, whether you’re at home or on the move.

Maximise Your Rewards: Enhance Your Rewards Experience

The RBS credit card rewards programme offers customers the opportunity to maximise their earning potential on everyday spending. Depending on the card, customers can earn points, cashback or other valuable benefits through their purchases. From earning 1% back in rewards at supermarkets to receiving up to 15% at selected retailers, the programme is designed to align with your financial goals and spending habits.

Whether you’re looking to redeem your rewards for travel, shopping or a statement credit, the RBS loyalty programme provides flexible options to suit your needs. Earn £4 per month by paying two or more direct debits, or £1 just by logging into the mobile banking app – small steps that can add up to significant savings over time.

By choosing the right RBS credit card, you can unlock a world of rewarding possibilities. Explore the range of cards and their unique features to find the one that best complements your lifestyle and spending patterns. Unlock the full potential of your RBS credit card and experience the benefits of a rewards programme tailored to you.

Frequently Asked Questions

Maximise Your Rewards: What credit card options does RBS offer?

RBS, the Royal Bank of Scotland, offers a range of credit cards that cater to diverse financial needs. Customers can choose from low-interest rate options, cards tailored for frequent travellers, or those seeking cashback and rewards programmes.

Maximise Your Rewards: How can I check my eligibility for an RBS credit card?

RBS makes it easy for customers to check their eligibility for its credit cards without impacting their credit score. Customers can explore the range of RBS credit cards and find the one that best suits their financial needs and spending habits.

Maximise Your Rewards: What features and tools does RBS provide for managing my credit card?

RBS provides its credit card customers with convenient tools and features to manage their accounts effortlessly. Customers can set up Direct Debits, track their transactions, review their statements, and even adjust their credit limits through the bank’s mobile app and online banking platform.

Maximise Your Rewards: What types of RBS credit cards are available?

RBS offers a diverse range of credit cards, including low-interest rate options, cards tailored for travel or everyday spending, and those with balance transfer and rewards programme capabilities. Customers can explore the bank’s credit card range to find the perfect fit for their financial needs.

How can I maximise my rewards with an RBS credit card?

RBS credit cards offer customers the opportunity to enhance their rewards experience. Depending on the card, customers can earn points, cashback, or other benefits on their everyday spending. RBS’s rewards programme allows customers to redeem their earned rewards for a variety of options, including travel, shopping, or statement credits.

Find out more at: https://www.rbs.co.uk/credit-cards.html